The Only RFQ-Based Perp DEX: Variational Explained

I’ve been researching perp DEXs for months.

Most are Hyperliquid clones. One stands out as genuinely different.

Variational isn’t just another DEX. It’s a new category entirely.

Here’s the deep dive.

What is Variational?

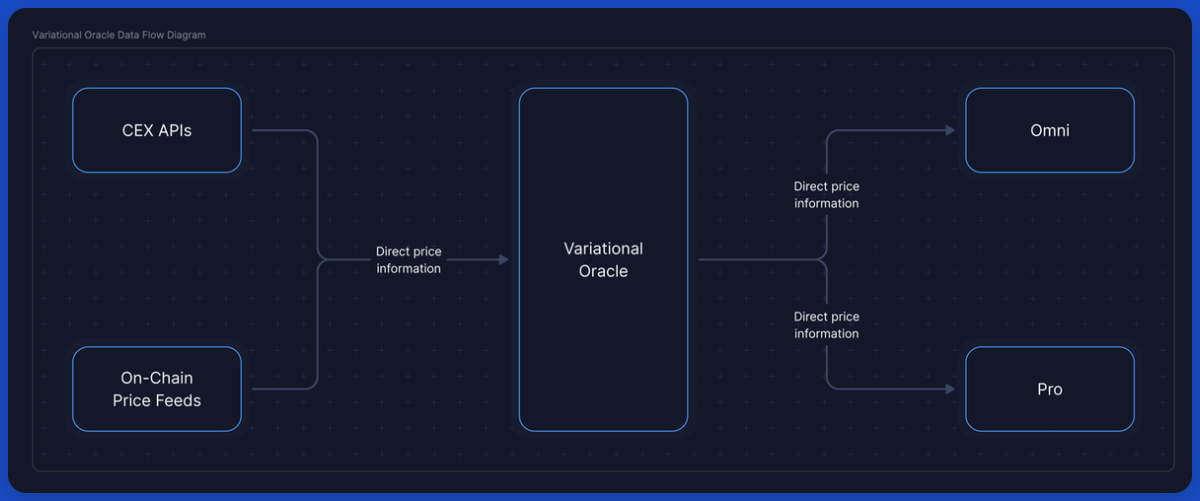

Variational is a peer-to-peer derivatives protocol on Arbitrum for trading, clearing, and settlement of perpetuals, options, and exotic derivatives.

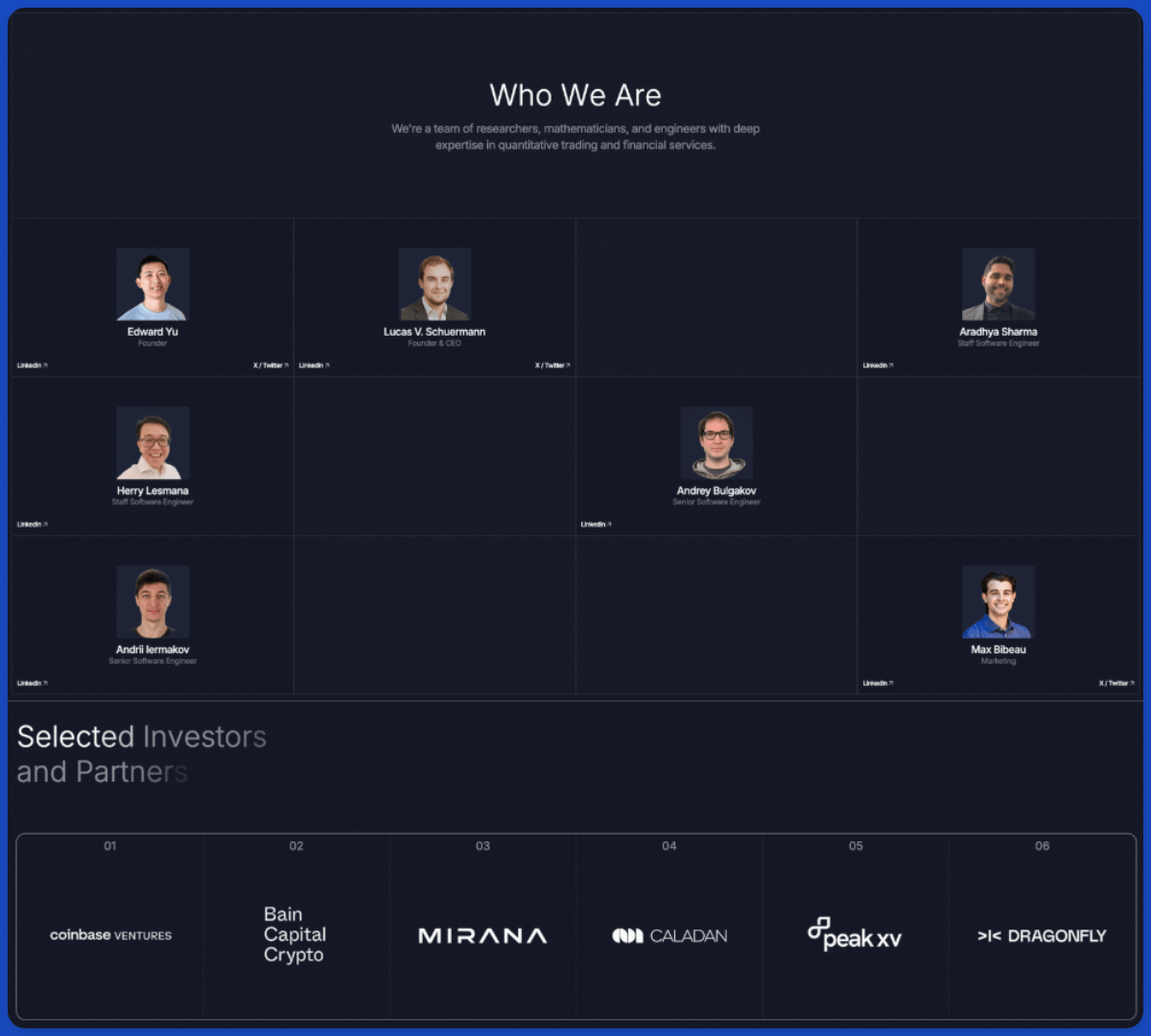

Founded by @variational_lvs and @mr_plumpkin—ex-hedge fund quants from Genesis Trading, DCG, and Columbia.

Raised $11.8M from Bain Capital Crypto, Coinbase Ventures, Dragonfly, Peak XV Partners, and Mirana among others.

This isn’t anon devs. This is institutional-grade infrastructure.

CLOB vs RFQ: Why Variational is Different

Most perp DEXs use CLOB (Central Limit Order Book):

Hyperliquid: own L1, 200k orders/sec

Lighter: ZK rollup on Arbitrum

dYdX: Cosmos chain

Variational uses RFQ (Request-for-Quote)—a completely different architecture.

How RFQ works:

You request a quote for your trade

OLP vault sources the best price from aggregated liquidity

You execute at that price with zero fees

The OLP captures spread instead of charging fees. You pay less than orderbook exchanges.

Variational is one of its kind in the perp DEX space using this model at scale.

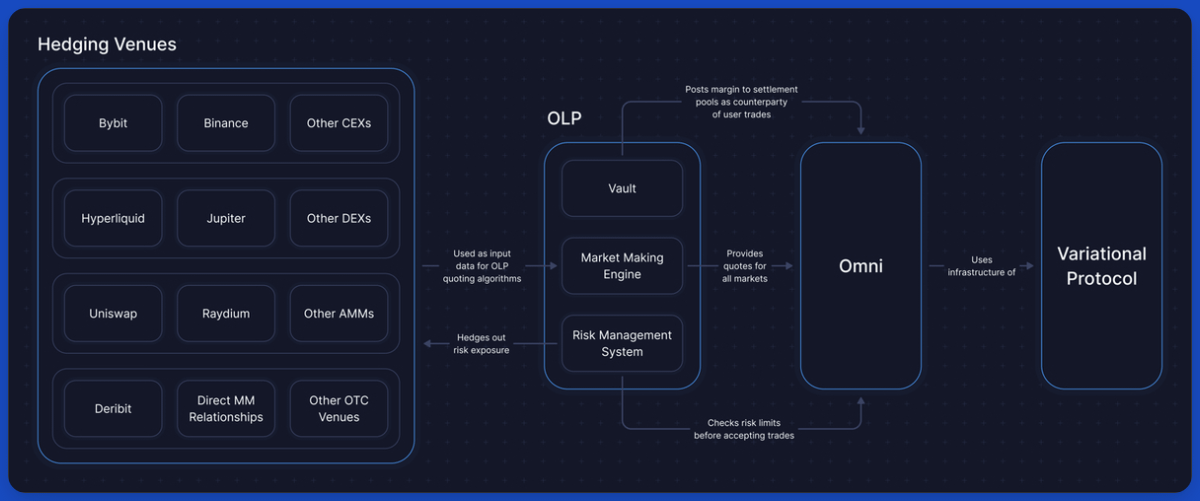

The Omni Liquidity Provider (OLP)

This is Variational’s secret weapon.

The OLP is a vertically integrated market maker and the sole counterparty to all trades.

It aggregates liquidity from:

Centralized exchanges (Binance, Bybit)

DEXs (Hyperliquid, others)

DeFi protocols

OTC channels

Result: Tightest spreads even on long-tail assets like memecoins.

Unlike Hyperliquid’s HLP or Lighter’s LLP (shared pools), OLP centralizes provision so ALL revenue flows back to the protocol.

This enables zero fees AND loss refunds. No other platform can do both.

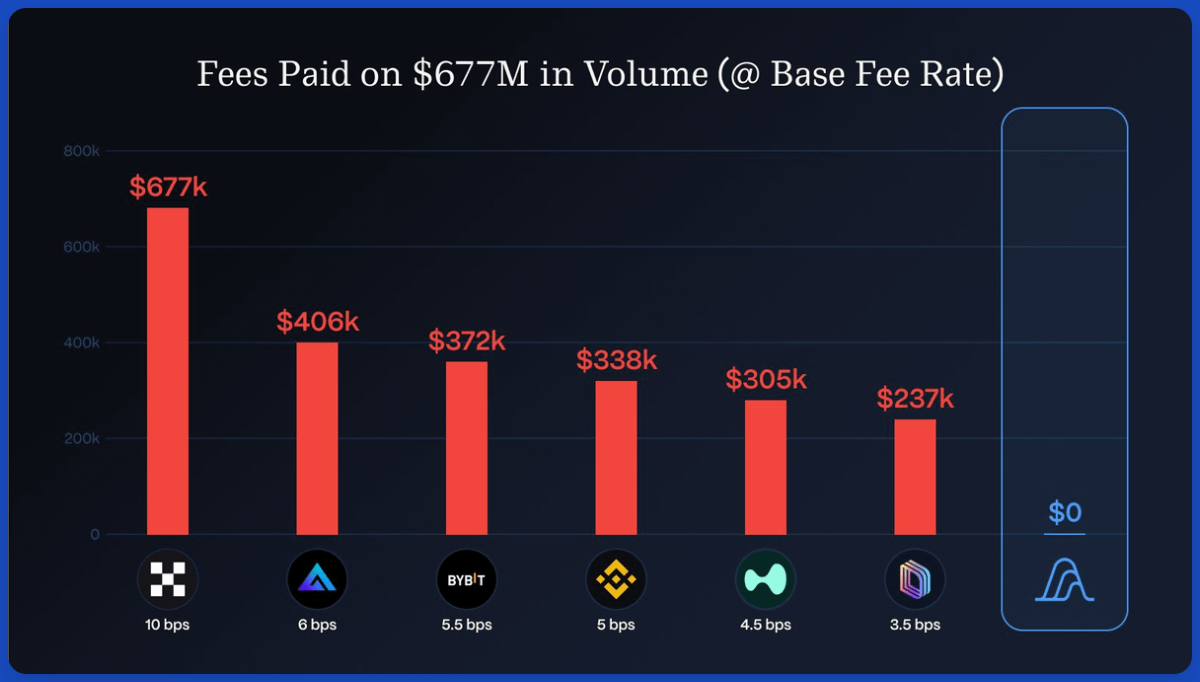

Zero Fees – Actually Zero

No maker fees. No taker fees. On any trade. Any size. Any market.

Only fee: $0.10 USDC for deposits/withdrawals (spam prevention).

If you trade $100K/month:

Hyperliquid: ~$35/month in fees

Binance: ~$40/month

Variational: $0

Over a year, that’s $400-500 saved. Over 5 years? $2,000+.

This is structural, not promotional. It’s how the protocol works.

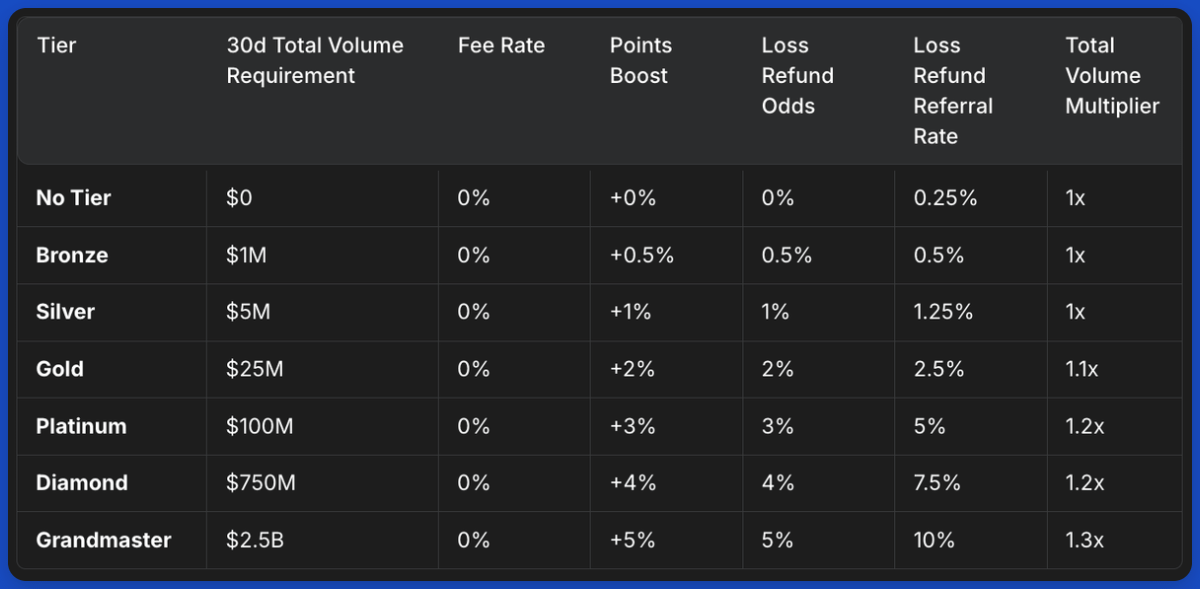

Loss Refunds – The Game Changer

Every losing trade >$1 has a chance to be FULLY refunded.

Odds based on your tier:

Bronze 0.5%

Silver 1%

Gold 2%

Platinum 3%

Diamond 4%

Grandmaster 5%

How it works:

10% of spread revenue funds the Loss Refund Pool

Payout: 100% of loss OR 20% of pool, whichever is smaller

Max 3 refunds per account per 24 hours

$0.10 gas fee

They’ve paid out $2M+ in refunds already.

This isn’t a gimmick. It’s a positive expected value on every trade.

Upcoming: OLP Pool with ~100% APY

Currently, OLP is seeded by the team.

Opening to users soon.

Depositors will earn from the vault’s market-making activity.

Early estimates: ~100% APY based on current spread revenue.

This is like being a market maker on Binance, but permissionless.

Variational Pro: Institutional OTC Desk

Most institutional OTC trading happens via Telegram chats. Manual. Slow. Risky.

Variational Pro automates everything:

Customizable derivatives products

Specific margin and liquidation rules

On-chain collateral escrow

Variational Oracle for pricing

Eliminates counterparty risk

This unlocks the trillion-dollar OTC derivatives market on-chain.

Currently on the waitlist. Testnet coming in 2026.

The Points Program & Airdrop

Here’s why people are paying attention NOW.

Points program is LIVE:

3M points retroactively distributed (27,000 addresses)

150,000 points distributed weekly

Runs through at least Q3 2026

Token allocation:

~50% of supply to community

30%+ of protocol revenue for buy-and-burn

Current point value estimates: $20-$40+ per point

Points Estimated Value 100 $3,000 500 $15,000 1,000 $30,000

And you’re paying ZERO fees while farming. The math is asymmetric.

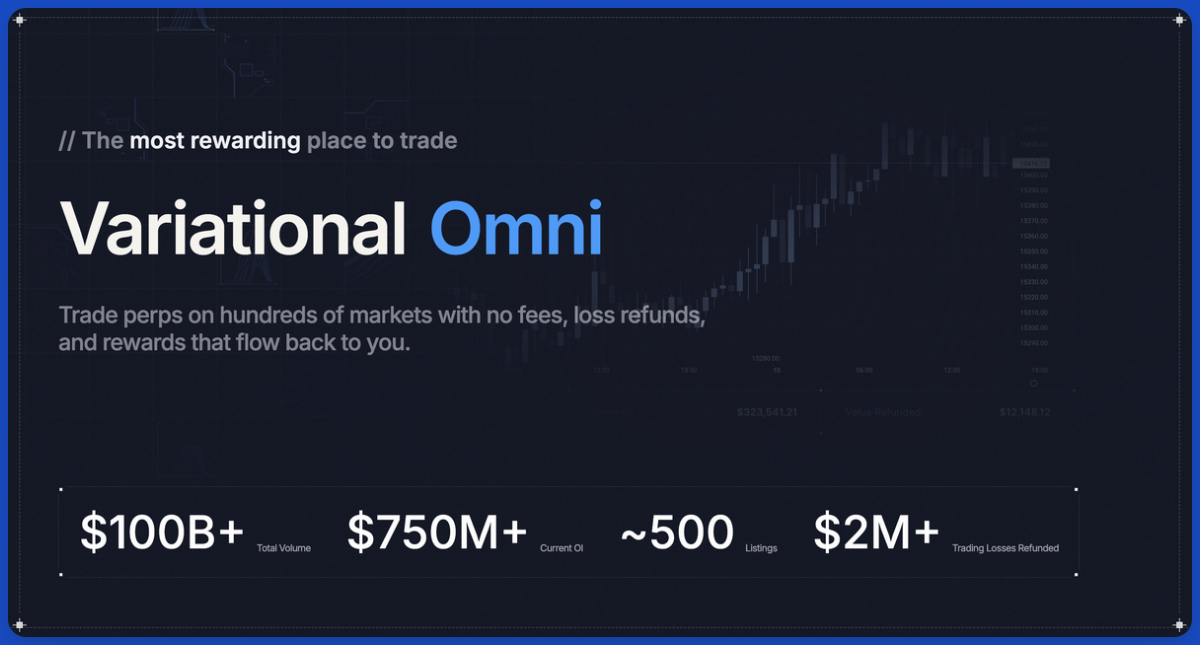

The Numbers (January 2026)

$100B+ lifetime volume

$900M-$1B open interest (#5 on DefiLlama)

$1.7B average daily volume

~15,000 daily active users

486+ markets (including memecoins, pre-launch tokens)

4th largest gas spender on Arbitrum

This is real traction, not testnet numbers.

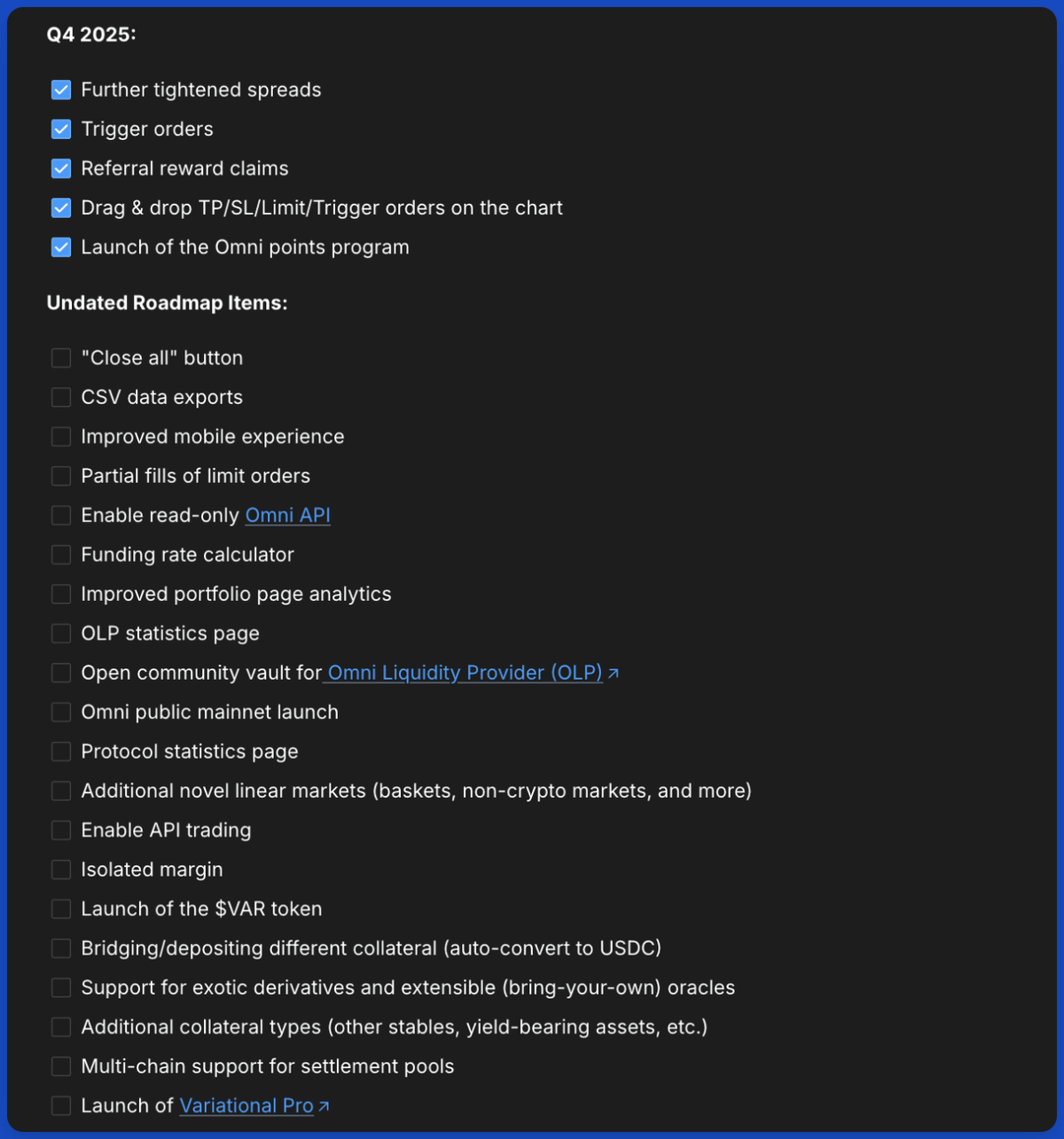

2026 Roadmap

The team just announced what’s coming:

Mobile support (web & app)

New order types (TWAP, scale)

RWA perps on Omni

User deposits into OLP (~100% APY)

Real-time protocol stats page

Variational Pro testnet

Points program conclusion → Token launch

They ship fast. This isn’t vaporware.

Why Variational Stands Out

In a market of Hyperliquid clones, Variational is genuinely different:

✓ Only RFQ-based perp DEX at scale

✓ True zero fees (not low—zero)

✓ Loss refunds (no one else has this)

✓ OLP pool coming (~100% APY)

✓ Institutional OTC product

✓ Points → 50% community airdrop

✓ $11.8M from tier-1 VCs

✓ Non-anon team with real credentials

This is building for the long term, not just riding incentive waves.

My Setup

Hyperliquid: BTC/ETH when I need deepest liquidity

Variational: Everything else—zero fees, airdrop, loss refunds

The combination gives you best execution AND best economics.

Bottom Line

Variational isn’t just another perp DEX.

It’s a new model for derivatives trading:

RFQ instead of CLOB

Zero fees instead of low fees

Loss refunds instead of just losses

OLP yields instead of just trading

If you’re trading perps, you should at least be testing this.

The airdrop opportunity alone justifies it. But the product stands on its own.

Get started with +12% points boost + Bronze badge:

omni.variational.io/?ref=OMNICORGIL

Not financial advice. DYOR. But don’t sleep on this one.